LL Flooring: Time To Pick Up The Cigar Butt On The Floor (NYSE:LL)

bill oxford

I previously covered LL Flooring Holdings, Inc. (NYSE:LL) and gave the stock a “Hold” rating. LL stock is a “hold” because of two major reasons:

- The company has a mediocre performance as it lacks competitiveness

- The hard surface flooring industry faces multiple headwinds because of the slowing housing market.

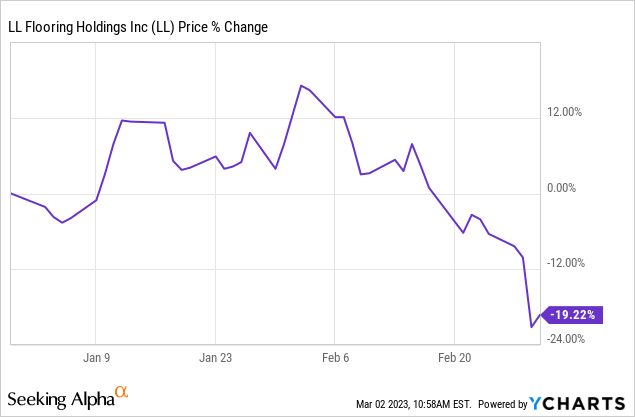

Although LL was down almost 20{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95} year-to-date, providing investors with a disappointing return, its valuation is quite attractive. As of 2 March 2023, the stock is trading at half its book value.

So, in this article, I discuss if LL is a good “cigar-butt” investment by analyzing its Q4 2022 earnings report and valuation.

Discussion on Q4 2022 Earnings Report

On 1 March 2023, LL had an upsetting earnings result. The company reported a non-GAAP EPS of -$0.29 in Q4 2022, which widely missed the Street’s estimates. Besides, comparable store sales and number of transactions also dropped 9.5{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95} and 17.7{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95} on a year-over-year basis.

Margins are discouraging as well. Gross margin of 35.9{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95} was lower than last year by 140 basis points.

The management reflected the underwhelming result in Q4 was caused by slower consumer spending, weak DIY demand, and a noncash goodwill impairment charge of $9.7 million.

This reaffirmed that the company lacks a competitive edge over its competitors. LL’s closest competitor, Floor & Decor Holdings, Inc. (FND), enjoyed a 9.2{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95} annual growth in comparable store sales in 2022, which proves its resilience during difficult times. On the contrary, LL’s total comparable store net sales decreased 5.8{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95} versus last year.

The macroenvironment is still challenging, led by a cooling housing market. The 30-year fixed rate mortgage rebounded to 6.50{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95} as strong employment data led to the resurgence of treasury yield.

The Housing Affordability Index issued by the National Association of Realtors reflected that the affordability of housing remains low. A family with median income shall barely have enough income to qualify for a mortgage on a median-priced home.

Inventory level of retailers is one of my major concerns entering 2023, and LL is no exception. As mentioned in LL Annual Report 2022:

“Merchandise inventories on December 31, 2022 increased $77.9 million from December 31, 2021 primarily due to increased purchases to replenish inventory to support the Company’s strategy to place inventory close to its customers and to support new stores, as well as, to a lesser extent, inflation.

Merchandise inventory per store also surged by near 50{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95}. The surge in inventories usually may lead to marked down prices, which shrink the margins significantly.

The management team is usually optimistic about the inventory level and believes the stocks are high quality and mixed solidly. However, given LL suffered a significant reduction in customer traffic (as the number of transactions has plummeted), I have a concern about its margins in the coming quarters.

The management team strategically reviewed the priorities to drive traffic and increased conversion to improve the sales performance. This includes:

- build greater awareness of the LL Flooring brand

- improved execution across our store network by offering a seamless omnichannel experience

- strengthening product expertise

- significantly reducing our new unit openings in 2023.

I discussed in my previous article that I believe LL is in an awkward position to compete. It is because LL is less accessible than large home improvement retailers, like The Home Depot (HD) and Lowe’s Companies (LOW) and offers less variety of products than its specialty retailing peers, such as FND.

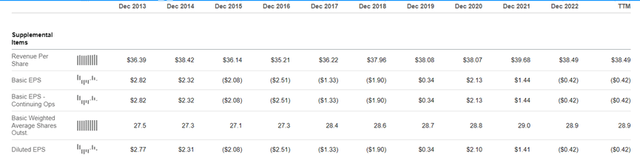

The proposal shall barely improve the situation that the company remains uncompetitive in short to mid term. As the company entered a downturn, the management intended to cut expenses to maintain its financial health. From past data, we can see that the company can be at loss for four consecutive years, which may lead to a weakening balance sheet eventually.

Seeking Alpha

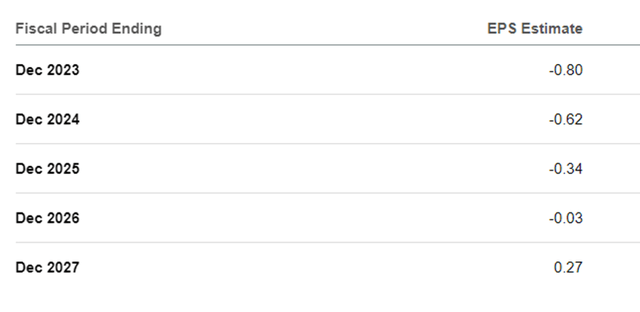

Analysts also anticipate the company will be at loss until 2027. Thus, it is sensible to reduce the debt level and cut capital expenses during a downturn.

Seeking Alpha

Though LL’s competitiveness shall remain weak, the company’s strategical revision on the priorities and its secular shift to focus on the Pro customers can improve the loyalty of customers and is beneficial for the long-term development of LL. This may improve future comparable store sales and drive the company back on track when the macro backdrop improves.

Together with the fairly solid balance sheet, I believe the company will not be in financial distress unless the situation deteriorates meaningfully.

Valuation

I mentioned at the start of the article that LL Flooring Holdings, Inc. is trading at only half of its book value, which sounds like an excellent opportunity for value investors.

Since 2019, Warren Buffett no longer displays Berkshire Hathaway Inc. (BRK.A, BRK.B) book value per share in its annual shareholder letter, as book value becomes less meaningful nowadays. As he mentioned in his 2014 shareholder letter:

Today, our emphasis has shifted in a major way to owning and operating large businesses. Many of these are worth far more than their cost-based carrying value. But that amount is never revalued upward no matter how much the value of these companies has increased. Consequently, the gap between Berkshire’s intrinsic value and its book value has materially widened.

Thus, I will further examine its balance sheet to find if price-to-book ratio is suitable for assessing the valuation of LL.

Referring to LL’s balance sheet, the company currently has $614 million in asset and $357.9 million in liabilities, representing a $256.1 million worth of book value.

Among $614 million asset, only less than $10 million is intangible asset, which is less than 2{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95} of asset value. Thus, I opine that the use of P/B ratio to assess LL valuation is still sensible and meaningful.

LL has a tangible book value per share of $8.92. It brings to a price to tangible book ratio of about 0.51 (as of 2 March), which proves the stock to be significantly undervalued.

Is LL Flooring a good “cigar butt” investment candidate?

Sufficient margin of safety is so important to investors as it provides a cushion to protect investors of making wrong decisions and unpredictable events (such as undelivered earnings result, lawsuit, etc.). Now, the company has a sufficient margin of safety as it is trading at near half its tangible book value.

The worst scenario for the company is to file for bankruptcy. However, I see the risk limited at the current moment for the following reasons.

- Long-term debt only $72 million with current asset of $369.7 million

- Debt-to-Asset ratio at 0.31

- Debt-to-Equity ratio at 0.8

- Book value around recent-year high.

I also believe that the book value of LL Flooring Holdings, Inc. will not decrease meaningfully as goodwill is only accountable for 2{ec3984a59f336e74413ebe8cd0979a3fa414de3884cb1e2a06779d998b58dc95} of the company’s asset. My thesis will require an reassessment if LL’s expenditure surges (e.g., M&A activities) or the company issues new debt offerings.

The company remains mediocre. But with all the above consideration, I shall upgrade LL Flooring Holdings, Inc. to “Buy” for investors with a three to five years investment horizon.